$5 Today is Worth More than $5 Tomorrow

Saving your hard-earned dollars is a better game plan than frivolously spending money. However, keeping your savings in cash (not investing the dollars) is also risky. This risk is called inflation. To substantiate inflation, we found the increase in price of Stumptown Coffee Roasters lattes since 2014.

**This article is not about Stumptown increasing the costs of their lattes. Suppliers, just like buyers, pay more for the goods they buy when inflation is rising. Stumptown consistently ranks among the best coffee shops in Portland!**

FLASHBACK! IT’S 2014…

You have $5.00 to go spend at Stumptown Roasters. That will buy you a delicious medium latte for $3.75 and a shortbread cookie for $1.25. Treat yourself!

Let’s say, instead of spending that $5.00 in 2014, you put it under your mattress for safe keeping. You find the $5.00 a few years later and still frequent Stumptown. We are going to run through a few scenarios of the purchasing power of that same $5.00 bill.

TWO YEARS HAVE PASSED, AND IT IS NOW 2016.

Your beloved medium latte now costs $4.00, and the shortbread cookie costs $1.35. You find $.35 in your pocket (does finding coins ever happen anymore?!), so you make the purchase possible.

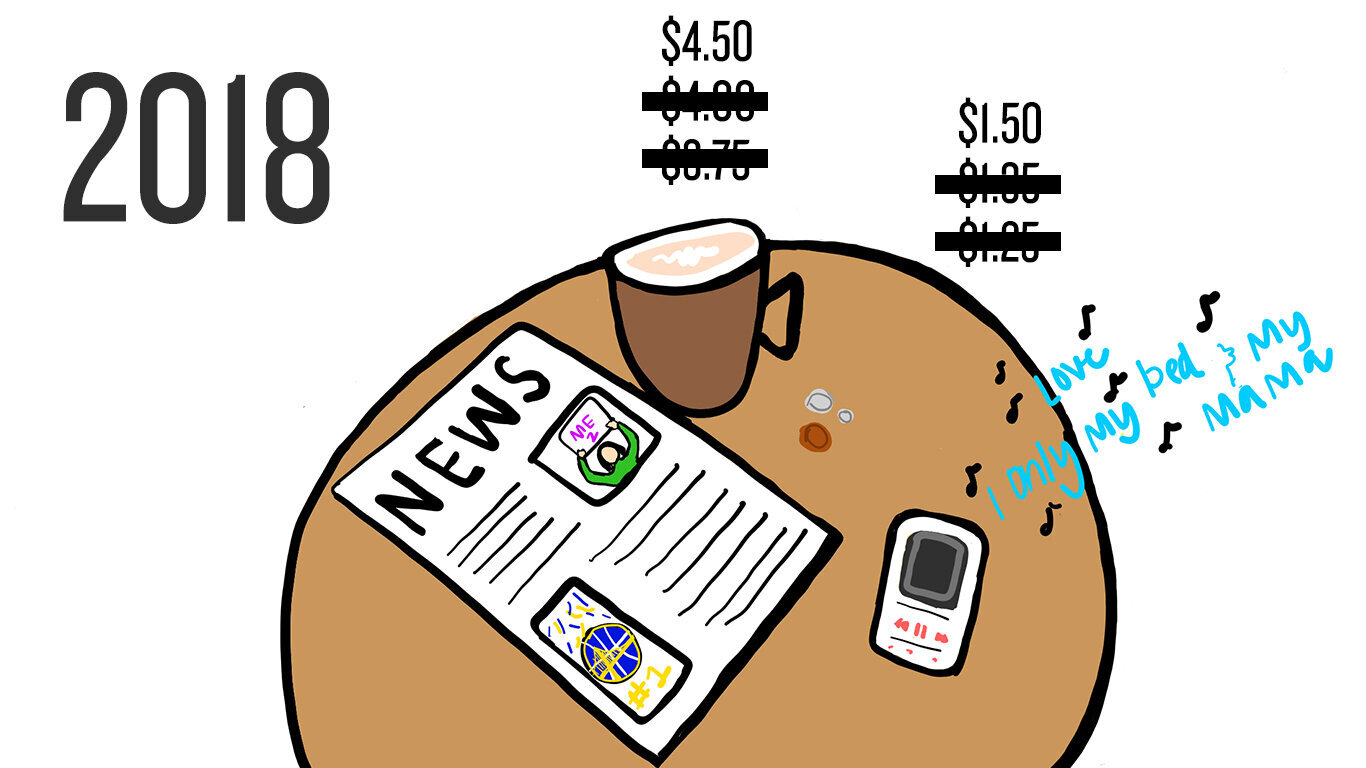

FOUR YEARS HAVE PASSED, AND IT IS NOW 2018.

That same tasty medium latte now costs $4.50, and the shortbread cookie costs $1.50. You might be going home hungry.

FAST FORWARD SIX YEARS TO 2020…

Your medium latte now costs $4.75, and the shortbread cookie costs $1.60. Assuming you would leave the barista a tip, your $5.00 bill cannot even buy you a coffee. You might be going home thirsty and hungry.

MAGNIFYING INFLATION’S EFFECTS ON BIGGER LIFE DECISIONS

In this example, the cost of a coffee and a cookie only changed by $1.33 over six years. While that may not seem significant (the increase is less than $2!), the cost of goods did increase by 26%. If you apply that percent increase to a larger purchase like a home, a car, or education savings, you may not be able to afford what you intended.

One way to maintain purchasing power is to invest the $5.00 into the stock market. If you bought the S&P 500 in 2014, then that same $5.00 would be worth around $9.40 today in 2020, which is enough to pay for a coffee and cookie from Stumptown. For simplicity purposes, we only looked at the rising cost of coffee and S&P 500 return since 2014. To further substantiate the decrease of purchasing power over time, we included a chart that compares the S&P 500 total return to the purchasing power of a dollar since 1990.

If you have questions or need help preparing an investment strategy for your savings, please contact our team at Human Investing. We drink good coffee.