Current housing market trends and what they mean for you

The housing market has always been a dynamic landscape, influenced by economic shifts, demographic changes, and societal trends. As we move through 2024, it’s clear that the housing market is experiencing significant transformations. From fluctuating interest rates to evolving buyer preferences, here’s a closer look at the key trends shaping the 2024 housing market and what they could mean for you. Withdrawal Rules for Traditional IRAs

Interest Rates and Financing

One of the most talked-about factors in the 2024 housing market is the interest rate environment. After years of historically low rates, we’ve seen mortgage rates reach 20-year highs as central banks worldwide grapple with inflationary pressures. In recent months, inflation has stabilized due to the higher rate environment, and some are predicting rate cuts starting as soon as September.

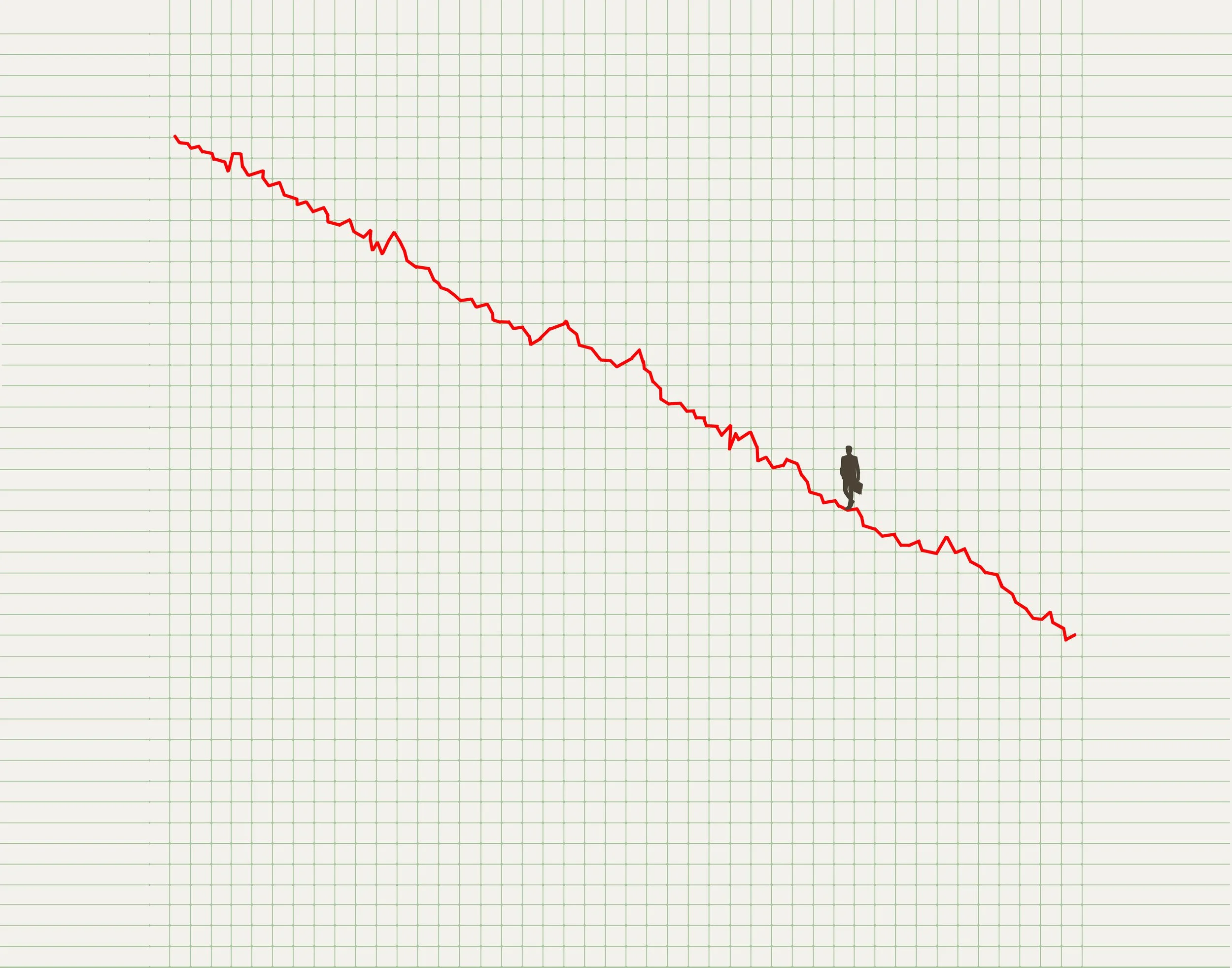

What This Means: Higher rates can increase monthly mortgage payments and potentially reduce purchasing power. Higher rates have kept some buyers on the sidelines waiting for mortgage rates to come down. If rates come down, we could see an uptick in the demand from buyers. However, if rates remain elevated sellers may face a more challenging environment. Higher rates could lead to many buyers staying on the sidelines or in their current homes with lower rates. Below is a chart showing how interest rates have moved over the last 5 years.

Housing Supply and Demand

The inventory of homes for sale has been a recurring issue in recent years, with many markets experiencing a shortage of available properties. Zillow did a recent analysis and found that the U.S. would need to build 4.5 million homes to have an adequate housing supply. In 2024, the supply of homes has seen some improvement, but it still struggles to keep pace with demand. Builders are ramping up construction, but new homes are not always in the price range or locations that buyers are seeking.

What This Means: The ongoing supply-demand imbalance continues to exert upward pressure on home prices, although at a more moderate rate compared to previous years. Buyers should be prepared for a competitive market, especially in popular areas. Sellers might benefit from favorable conditions if their properties are well-priced and well-maintained.

Remote Work and Lifestyle Changes

The shift toward remote and hybrid work arrangements has had a lasting impact on housing preferences. Many people are seeking homes with dedicated office spaces or properties in less densely populated areas where they can enjoy a higher quality of life.

What This Means: Suburban and rural areas may see continued demand as more people seek out larger homes with more amenities. Urban centers might experience slower growth in housing prices, especially if they cannot offer the same quality of living as suburban or rural areas. Buyers looking for a home with space for an office or a quieter environment might find opportunities in markets that were previously less desirable.

In conclusion, the 2024 housing market is characterized by a complex interplay of higher interest rates, evolving buyer preferences, and ongoing supply constraints. Due to these factors, the housing market likely won’t slow down anytime soon. Prices have remained elevated even with higher mortgage rates. If mortgage rates start to come down as forecasted, we will see an influx of buyers in a market that is already short on inventory, thus driving prices even higher. Whether you’re looking to purchase a home, sell your property, or invest in real estate, understanding and monitoring these trends will help you make more informed decisions in a market that continues to evolve.

As always, working with a knowledgeable real estate professional can provide valuable insights and guidance tailored to your specific needs and goals.