Five Smart Ways to Spend Your Tax Refund

Tax season often comes with the sweet surprise of a refund—and while it might feel like a bonus, it’s actually a golden opportunity to make strategic moves for your financial future. Instead of just spending it without a plan, consider how you can put that money to work in a way that aligns with your goals. Here are some smart, thoughtful ways to use your tax refund to improve your financial situation:

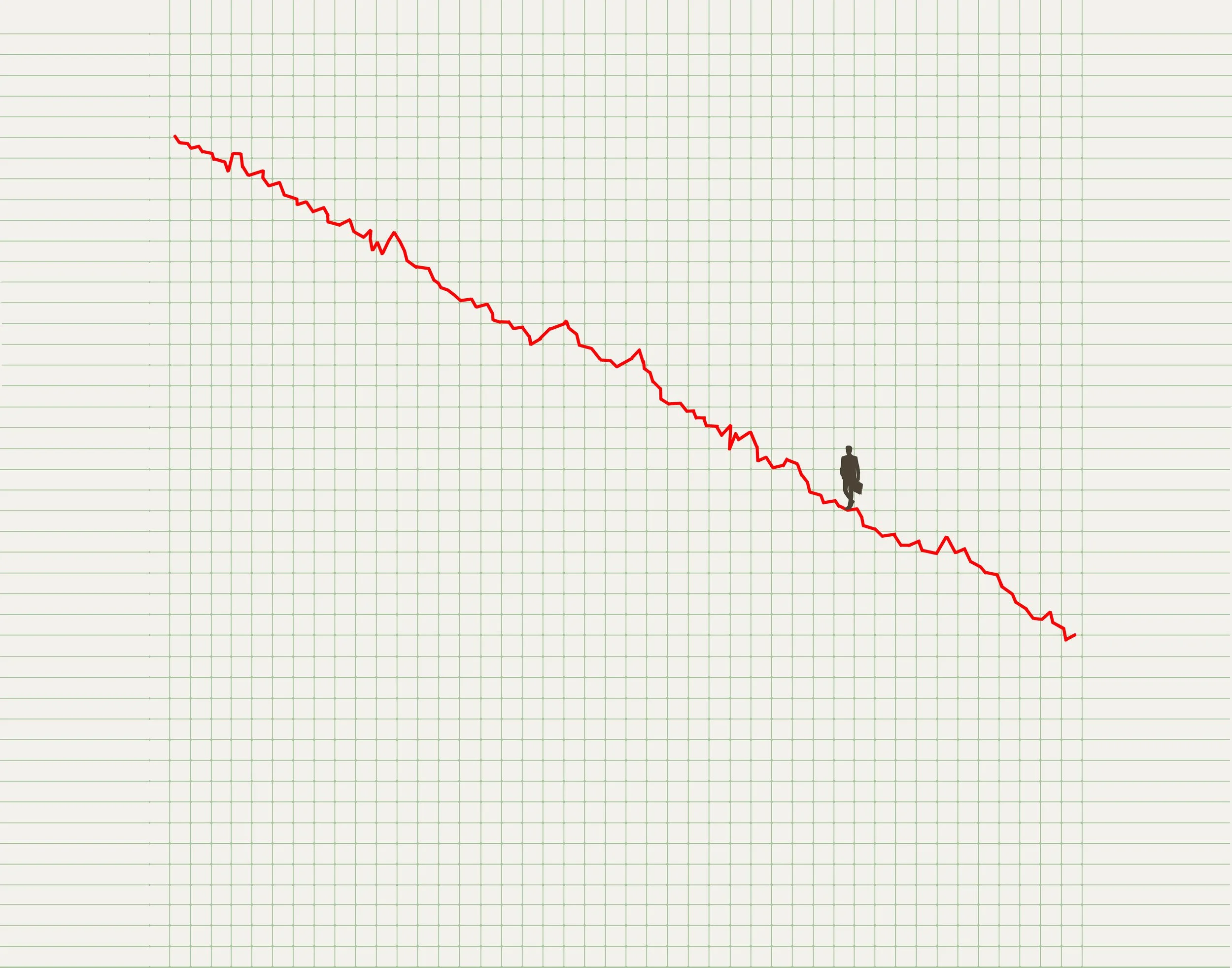

1. Pay down high-interest debt

If you have debt over 7%, like credit cards or car loans, your tax refund is a great opportunity to reduce those balances. Paying down high-interest debt is a guaranteed return – and it can be one of the most effective ways to improve your financial health.

2. Boost your retirement savings

Whether you're contributing to a 401(k), IRA, or another retirement vehicle, putting your refund toward your retirement fund is a strategic move for your future. Take advantage of matching contributions in employer-sponsored accounts first, then think about your current versus future tax bracket. If you’re in a lower bracket today than you will be in the future, talk to your advisor about Roth 401(k) or Roth IRA options. The earlier you invest, the more your money can grow.

3. Build or strengthen your emergency fund

If your emergency fund could use some attention, now’s the time to top it off. Having a well-funded emergency savings account provides financial stability and peace of mind when unexpected costs arise. If you’re self-employed, a six to 12-month fund is appropriate. For those with W2s, three to six months is typically adequate. A strong emergency reserve will prevent you from accruing high-interest debt that chips away at your savings.

4. Give back or pay it forward

If your financial situation allows, consider giving a portion of your refund to a cause or charity that’s important to you. Whether you’re supporting a local organization or a larger initiative, charitable donations can help create a positive impact while also offering potential tax benefits.

5. Enjoy thoughtfully (without guilt)

It’s important to enjoy the rewards of your hard work—and your tax refund is a perfect chance to do so. A thoughtful splurge can enrich your life without derailing your financial progress, whether it’s an experience or something you’ve been eyeing for a while. The key is to choose something that adds lasting value or joy, rather than making impulse purchases that won’t stand the test of time.

Keep working towards your goals

Your tax refund is an opportunity to make strategic financial decisions (and, possibly, have some strategic fun) that align with your priorities. Whether you decide to strengthen your savings, reduce debt, invest for the future, or treat yourself in a meaningful way, making intentional choices will help you build a stronger financial foundation for the months and years ahead.