Equity Returns are in your Favor: The Positives Outweigh the Negatives

“Stocks are too risky for me.”

“You shouldn’t invest anything in stocks unless you’re prepared to lose all of it.”

“Investing is just another form of gambling.”

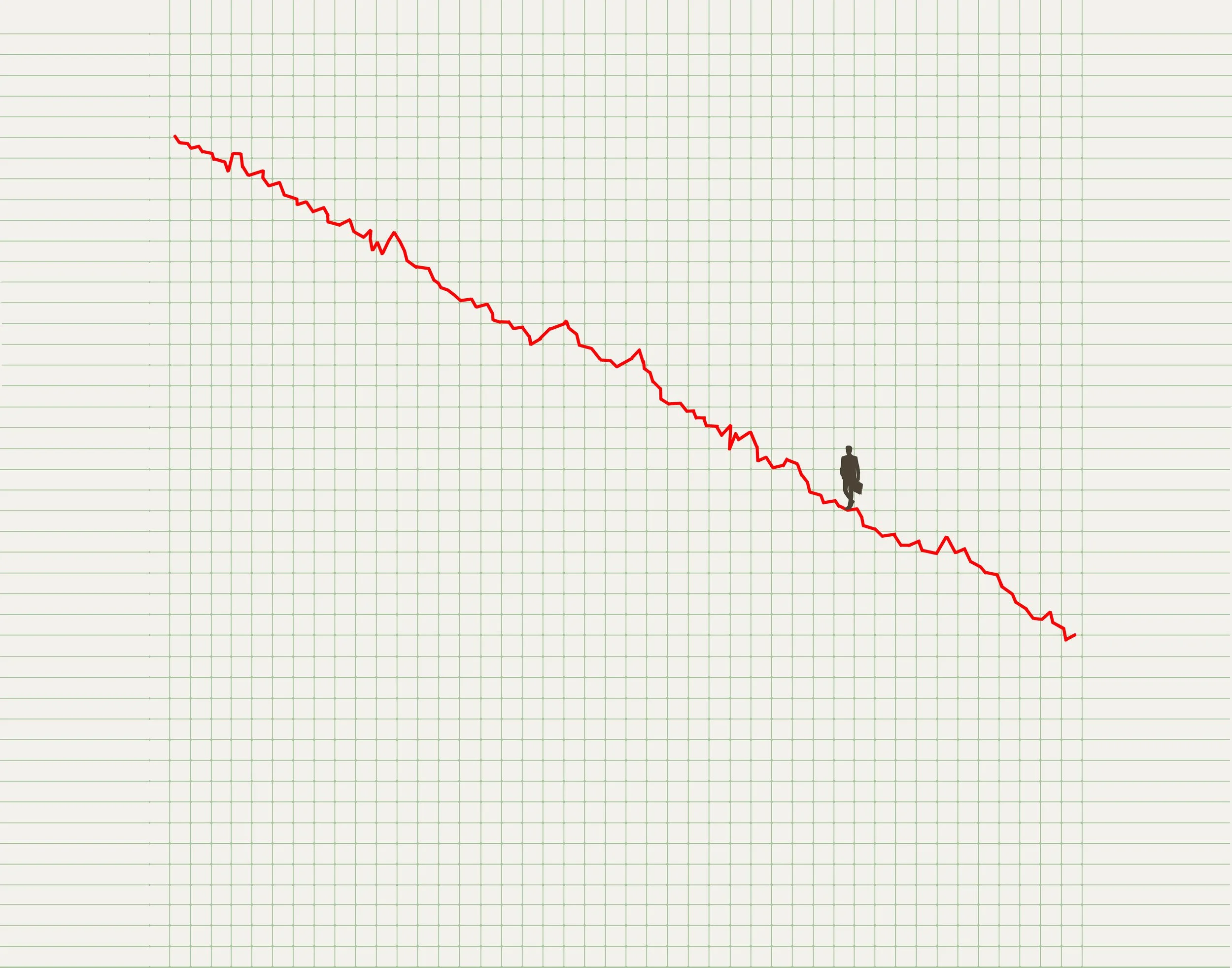

I have heard these concerns and many other reasons why people are nervous about investing, particularly in stocks. The ups and downs of the stock market can be difficult to stomach. This year, we saw one of the fastest drops in history as COVID-19 hit the world. The S&P 500 was down just over 30% from the beginning of 2020. Then stocks rallied back. At the end of July, the S&P 500 was positive for the year 2020. This is a wild ride no matter how you look at it.

The fear of short-term losses in investing is referred to as “myopic loss aversion”. The idea is that the fear of short-term losses scares investors away from riskier assets like stocks. As such, investors tend to invest more conservatively than they should, resulting in lower long-term returns.

Long-term stocks are a wonderful tool to grow your assets above the rate of inflation. Growing your savings and spending power over time is attractive, and for many it is essential to achieve their financial goals. The volatility of stocks along the way? No one looks forward to that.

HOW RISKY ARE STOCKS IN ANY GIVEN YEAR?

If we look at historical returns for the S&P 500, a curious picture emerges:

Since 1937, the S&P 500 has had a positive return in 63/83 years, or 76% of the time. For reference, that is a solid “C” and a passing grade in any class I have taken.

For example, pretend you put $100 in the stock market on January 1 every year. In years with a positive return (76% of the time), on average you would see that $100 grow by 19.61% to $119.61. In years with a negative return (24% of the time), you would see that $100 shrink by an average of -12.19% to $87.81. Long-term, the odds are in your favor to grow your assets.

INVEST WITH A STABLE FOUNDATION

There are certainly risks to owning stocks. It is important to ensure you have an emergency fund to cover unexpected job loss or life expenses. It is also important to determine how much risk you can handle, both financially & emotionally, so you are not tempted to panic and sell when you see your account balance go down. A financial plan may be helpful to illustrate the dangers of investing too conservatively or too aggressively and may help to determine the risk that makes best sense for you.

If you need help understanding the risks and benefits of investing in equities, please contact our team at Human Investing.