Combating the investing FOMO (and FOBI) in all of us

In a recent interview Jason Zweig, a personal finance columnist for the WSJ, had a quote that resonated with me.

"Emotional discipline is the single hardest thing about the investment game."

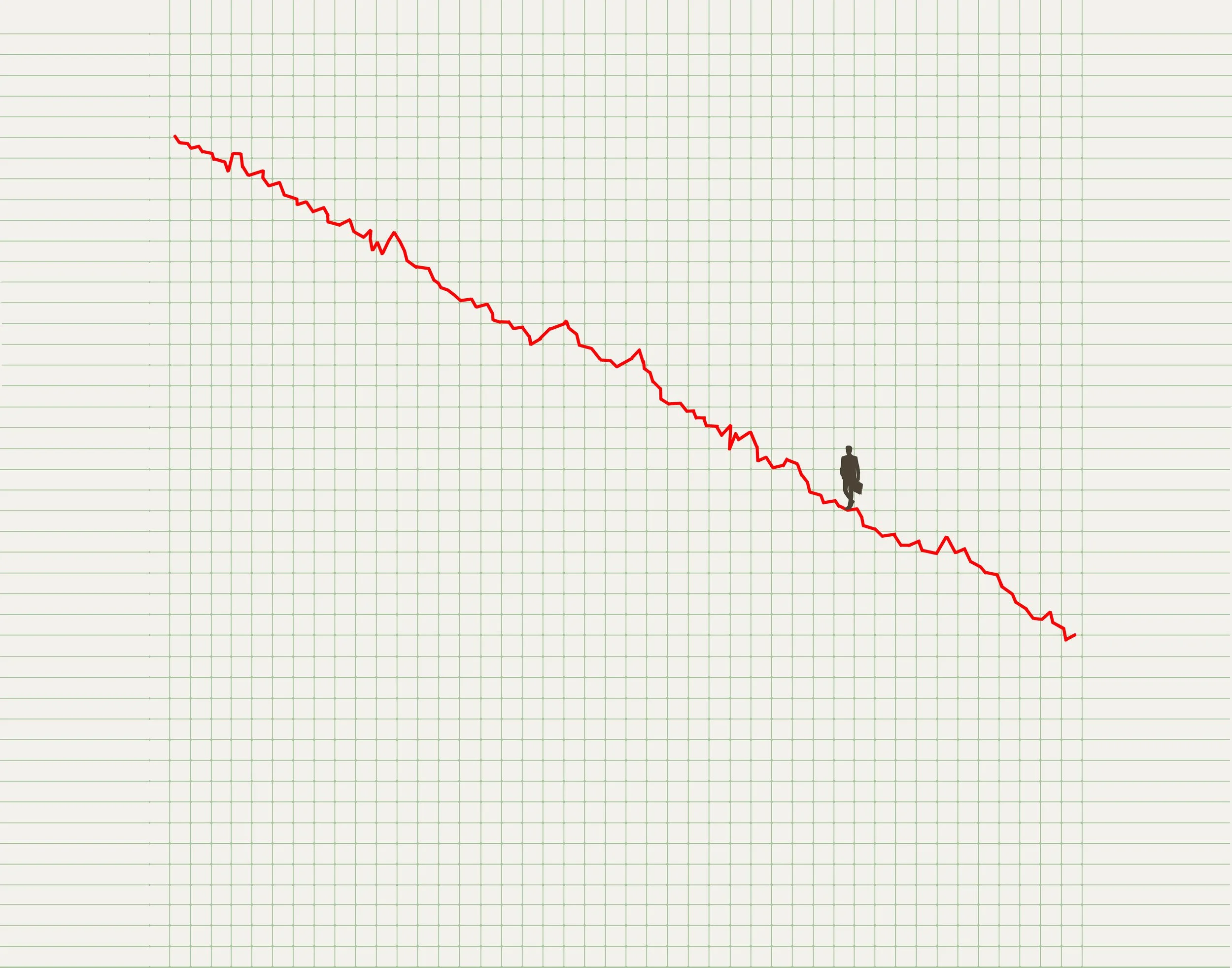

After accumulating over 30 years of writing and thinking about investing and personal finance, Jason points to emotion (not market valuations, stock picking, or market corrections) as the most difficult part of investing. As financial advisors, we witness the struggle of emotional discipline firsthand. Recent news (and noise) around tech stocks, housing prices, federal spending, cryptocurrencies, inflation, and interest rates have made it more difficult for investors to maintain this discipline.

ARE YOU AN INVESTOR FACING FOMO OR FOBI?

This lack of emotional discipline manifests itself typically in one of two ways:

Fear of Missing Out (FOMO) in the market. If you are 15 years old, FOMO is seeing your friends doing something without you on social media. If you are an investor, FOMO is the internal dialogue of “I see my neighbor making money on ____, I need to buy ___.” Someone who has FOMO tends to follow the crowds. FOMO can lead an investor to think their rate of return is a benchmark for their success rather than achieving a return needed for a successful financial plan.

Fear of Being In (FOBI) the market. FOBI is the internal dialogue of “I have seen how this story ends. I need to sell ____.” Someone who has FOBI likely listens to news sources who make a profit off pessimistic news. Note: It is easy to push the sell button, it is always harder to get back in.

FOMO and FOBI may seem different, however, both are ultimately trying to guess where the market will go next and are speculative in nature. Let 2020 be a great reminder that it’s difficult to predict how the market or a particular investment will do year to year.

PERIODIC TABLE OF INVESTMENT RETURNS FROM THE LAST 20 YEARS

One of my favorite charts to illustrate the difficulty to predict short-term performance is "The Periodic Table of Investment Returns". This graph ranks the annual returns of popular asset classes from best to worst over the last 20 years.

Source: Blackrock; Past performance is no guarantee of future results. The information provided is for illustrative purposes and is not meant to represent the performance of any particular investment. Assumes reinvestment of all distributions. It is not possible to directly invest in an index. Diversification does not guarantee a profit or protect against loss.

An investor experiencing FOMO is likely paying attention to the top row, the best-returning asset classes over the last 20 years. This investor is likely trying to guess what will be the highest performing asset class in the coming year.

Meanwhile, an investor experiencing FOBI is likely paying closer attention to the bottom rows, with a specific focus on larger market selloffs like 2001, 2002, and 2008. A FOBI investor is worried about being invested in the wrong asset class and will try to avoid the worst-performing asset class in the coming year.

THE PERIODIC TABLE OF INVESTMENT RETURNS REMINDS ME OF THREE INVESTING TRUTHS:

It can be dangerous to try and guess what is next. Consider US small-cap stocks (Sm Cap – in light green), which had the highest average annual return over the 20 years. While small-cap stocks were the best performer they also showed the widest variance in outcomes. Guessing right in 2003 would have provided a positive return of 47.3%. Guessing wrong in 2008 would have provided a negative return of 33.8%.

Past performance is not an indicator of future returns. Making investment decisions based on recent performance (e.g., looking at 1, 3, and 5-year returns) can be detrimental to an investment portfolio. International’s performance as a prime example (Int’l – in yellow), over the five years from 2003-2007 international was the best performing asset class by a long shot. International seemed like the sure thing. Unfortunately, the investors who followed international’s high returns were greeted with a brutal 43% selloff in 2008.

Portfolio diversification is the answer to combating FOMO and FOBI – See “Div portfolio” in purple along the middle rows. Diversification is an investment strategy that aims to maximize a level of return for the risk desired. Diversification accomplishes this by strategically spreading money across different types of investments.

A diversified portfolio helps investors maintain emotional discipline. Diversification can avoid the fear of missing out on the next hot investment. Owning more of the market will naturally provide more opportunities to not miss out on the growth of specific sectors or individual investments. Diversification can also temper being fearful of being in the market and owning the next big loser. Diversification disperses your dollars across many asset classes, which means if one company is a dud it will not sink the ship.

If you struggle with emotional discipline when investing, congratulations you are a human. If helpful, please use The Periodic Table of Investment Returns as a great reminder that emotional discipline is difficult. Putting a plan in place along with proper diversification can help investors make smart long-term decisions.