Exploring the concept of a US Central Bank Digital Currency (CBDC)

In recent years, the concept of digital currencies has moved from the fringes of finance to the forefront of economic policy discussions. Among these, the idea of a Central Bank Digital Currency (CBDC) is particularly significant. As countries worldwide explore the potential of CBDCs, the United States is also considering the implications of launching its own digital dollar. This blog post delves into what a US CBDC could entail, its potential benefits, challenges, and what it means for the future of money.

What is a Central Bank Digital Currency (CBDC)?

A CBDC is a digital form of a country's national currency, issued and regulated by the central bank. Unlike cryptocurrencies such as Bitcoin, a CBDC is not decentralized; instead, it operates within the centralized framework of the country's financial system. This ensures the stability and trust typically associated with traditional fiat currencies while leveraging the efficiency and innovation of digital payment technologies.

Potential Benefits of a US CBDC

Financial Inclusion: One of the most compelling arguments for a US CBDC is its potential to enhance financial inclusion. A digital dollar could provide unbanked and underbanked populations with easier access to financial services, reducing barriers to economic participation.

Efficiency and Cost Reduction: Digital currencies can streamline payment systems, reducing the costs and inefficiencies associated with physical cash. Transactions can be faster and cheaper, benefiting both consumers and businesses.

Improved Monetary Policy Implementation: A CBDC could provide the Federal Reserve with more precise tools for implementing monetary policy. Real-time data on money flow and spending could enhance the effectiveness of policy measures.

Combating Financial Crime: Digital currencies offer greater transparency and traceability compared to cash, potentially reducing illicit activities such as money laundering and tax evasion.

Challenges and Considerations

Privacy Concerns: One of the significant concerns with a CBDC is the potential for increased government surveillance of financial transactions. Ensuring robust privacy protections will be crucial to gaining public trust.

Cybersecurity Risks: A digital currency system would be a prime target for cyberattacks. The infrastructure supporting a CBDC would need to be highly secure to prevent breaches that could undermine confidence in the currency.

Impact on Banking System: A CBDC could disrupt the traditional banking model, as individuals might prefer holding digital dollars directly with the central bank rather than in private banks. This could affect banks' ability to lend and manage liquidity.

Technical and Operational Challenges: Developing and implementing a CBDC involves significant technical complexities. Ensuring interoperability with existing financial systems and addressing issues such as scalability and resilience are critical tasks.

The Current State of US CBDC Development

As of now, the United States has not yet committed to issuing a CBDC. However, the Federal Reserve has been actively researching and exploring the feasibility and implications of a digital dollar. In January 2022, the Federal Reserve released a discussion paper titled "Money and Payments: The U.S. Dollar in the Age of Digital Transformation," which outlines the potential benefits, risks, and policy considerations of a CBDC.

Federal Reserve Chair Jerome Powell has emphasized the importance of getting the design and implementation of a CBDC right, rather than rushing to be the first to launch. This cautious approach reflects the complexity and far-reaching implications of introducing a digital dollar.

The Global Context

Globally, several countries are moving ahead with their own CBDC projects. China is one of the leaders in this space, having conducted extensive pilots of its digital yuan. The European Central Bank is also exploring the development of a digital euro. These international developments add pressure on the US to consider its own position in the evolving landscape of digital currencies.

There is more to consider before determining the lasting benefits of a CBDC

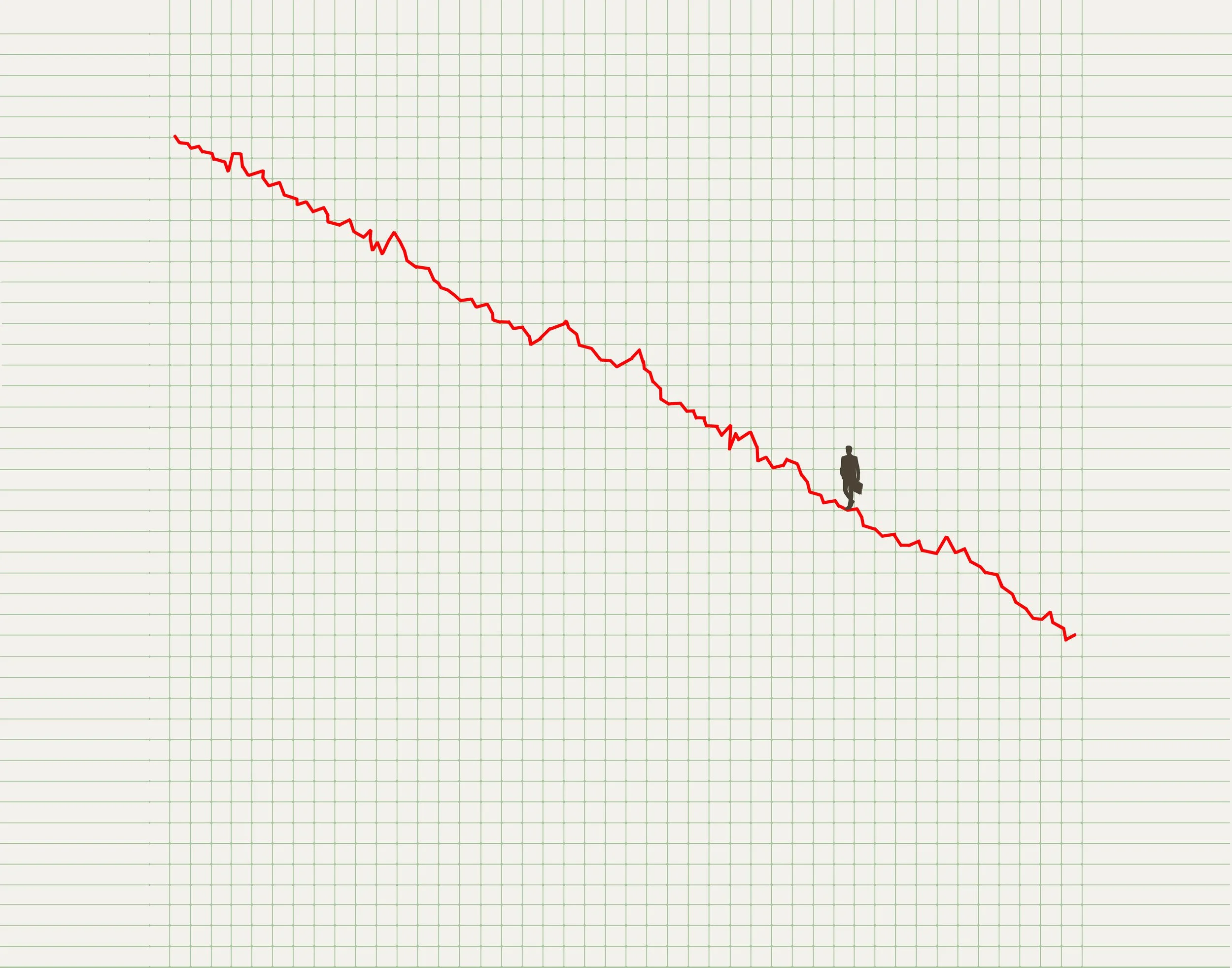

While the US is actively exploring the concept of a CBDC and acknowledges its potential benefits, several factors contribute to a cautious and deliberate approach. These include the need for extensive research, legislative action, technological development, and consideration of economic impacts. As such, the likelihood of the US launching a CBDC in the near future appears low, with a more probable scenario being a gradual and methodical progression towards potential implementation over an extended period.

In a March 2024 Senate meeting Jerome Powell said, “People don’t need to worry about a central bank digital currency, nothing like that is remotely close to happening anytime soon," He added that the Fed has no interest in establishing accounts for individuals that would compete with the banking system, and it would not support any Fed monitoring of personal financial transactions.

Given the complexity and significance of such a move, it is essential to stay informed about ongoing developments and discussions but as disclosed by the Federal Reserve, any significant changes still appear to be in the distant future.