Which Real Estate Investment makes the most sense for me?

Real estate investments have long been considered a pivotal asset in portfolio diversification. Historically, investing in real estate has often meant purchasing physical properties, managing tenants, and dealing with maintenance issues. However, in today's digital age, there are alternative ways to invest in real estate that offer varying levels of involvement and risk. Below we'll explore three popular methods: rental properties, real estate crowdfunding, and Real Estate Investment Trusts (REITs). We'll highlight their advantages, considerations, and how they contribute to a diversified investment strategy.

Rental Properties:

Investing in rental properties involves purchasing residential or commercial properties to generate rental income. Here are some key points to consider:

Tangible Asset: Owning rental properties provides investors with a tangible asset that can appreciate over time. Unlike stocks or bonds, which are intangible, real estate offers the benefit of physical ownership.

Passive Income: Rental properties can generate steady, passive income through rental payments from tenants. This income can be used to cover mortgage payments and maintenance costs, while generating profit.

Property Management: Although rental properties offer passive income, they do require management. Investors must handle tenant issues, property maintenance, and other operational tasks unless they hire a property management company, which would incur additional costs.

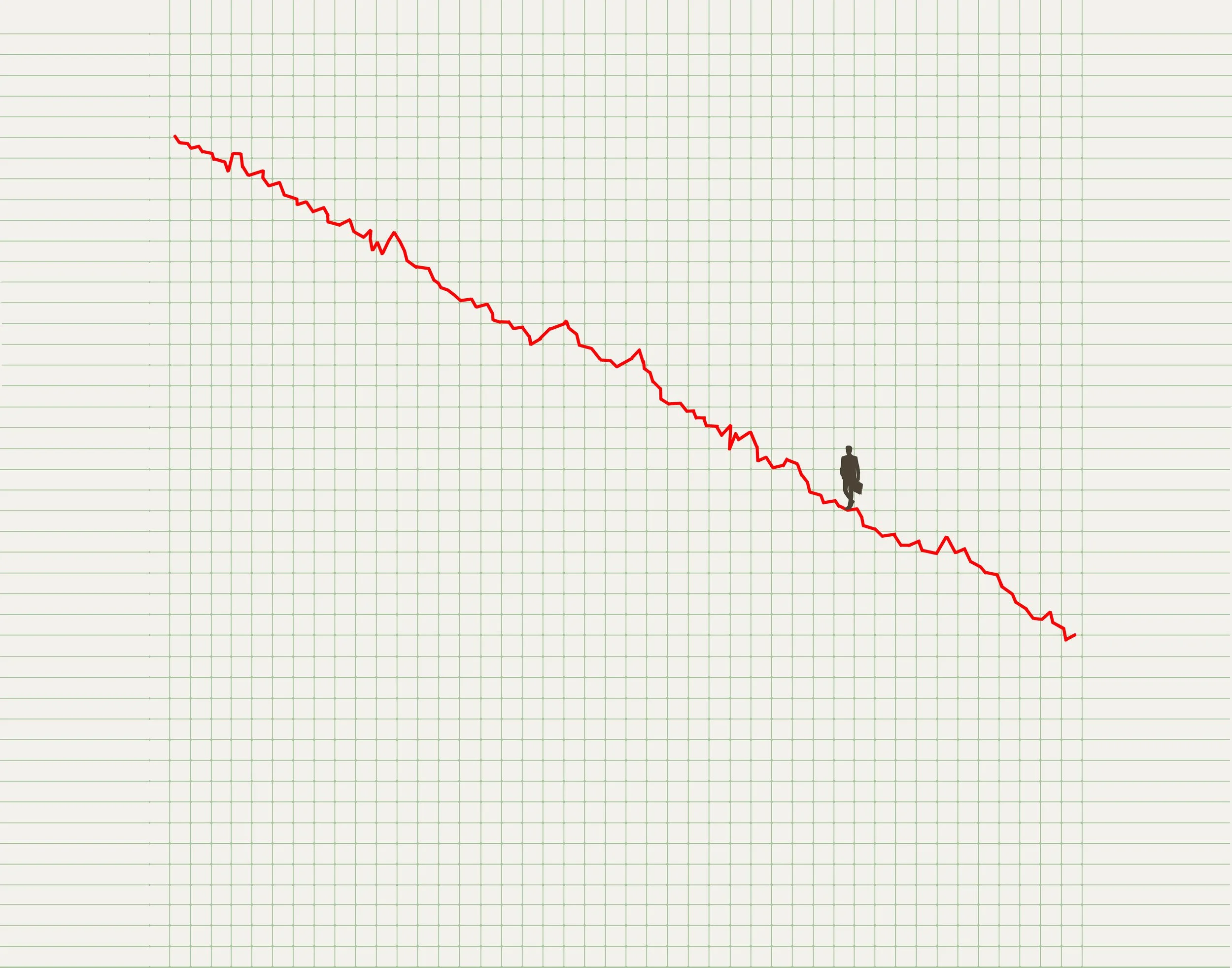

Market Risks: The real estate market is subject to fluctuations in property values, rental demand, and interest rates. Investors should conduct thorough market research and due diligence before purchasing a rental property to mitigate risks.

Real Estate Crowdfunding:

Real estate crowdfunding platforms have emerged as an alternative investment option, allowing individuals to invest in real estate projects alongside other investors. Here's how it works:

Diversification: Crowdfunding enables investors to diversify their portfolios by investing in multiple properties or projects with smaller amounts of capital. This diversification helps spread risk across different assets and markets.

Accessibility: Real estate crowdfunding platforms have lowered the barrier to entry for investors, allowing individuals to participate in real estate deals with lower minimum investment requirements compared to traditional real estate investments.

Passive Investing: Unlike owning rental properties directly, real estate crowdfunding offers a more passive investment approach. Investors contribute capital to a project and receive returns based on the project's performance without having to manage the property themselves.

Due Diligence: While real estate crowdfunding offers accessibility and diversification, investors should conduct thorough due diligence on the platform, the sponsoring company, and the specific investment opportunity to assess risks and potential returns.

Real Estate Investment Trusts (REITs):

REITs are companies that own, operate, or finance income-generating real estate across various sectors. Investing in REITs provides several benefits:

Liquidity: REITs are traded on stock exchanges, providing investors with liquidity compared to owning physical properties, which can be less liquid and require time to sell.

Dividend Income: REITs are required by law to distribute a significant portion of their income to shareholders in the form of dividends. This consistent income stream can be attractive for income-oriented investors.

Diversification: REITs offer exposure to a diversified portfolio of real estate assets, including commercial properties, apartments, healthcare facilities, and more. This diversification helps spread risk across different sectors and geographic regions.

Professional Management: REITs are managed by experienced real estate professionals who handle property acquisition, management, and leasing, relieving investors of the burden of property management.

If you are investing using our portfolios at Human Investing, you will own REITS in the underlying Index funds.

Diversifying your real estate portfolio through rental properties, real estate crowdfunding, and REITs can provide numerous benefits, including passive income, portfolio diversification, and potential for capital appreciation. Each investment option offers unique advantages and considerations, and investors should carefully assess their financial goals, risk tolerance, and investment horizon before deciding which approach or combination of approaches suits their needs best. Whether you prefer hands-on property ownership, passive investing through crowdfunding, or the liquidity and diversification of REITs, real estate offers a variety of avenues for building wealth and achieving financial success.