In September 2024, the Federal Reserve convened for its monthly meeting, resulting in a widely anticipated decision to cut interest rates by 0.50%. This marks a significant move as the Fed responds to ongoing economic changes and switched gears from economic tightening to easing economic policy. Let’s break down the meeting highlights, the rationale behind the rate cut, and what it means for you.

Read MoreIn the realm of charitable giving, Qualified Charitable Distributions (QCDs) represent a powerful yet often underutilized tool for both donors and charities. If you’re looking to maximize your philanthropic impact while potentially benefiting from tax advantages, QCDs are worth exploring. In this blog, we’ll dive into what QCDs are, how they work, and why they might be a great option for you.

Read MoreWhen it comes to employer benefits, health insurance is often one of the most impactful. As medical costs continue to rise, it’s essential to look at all the options available to you and your family.

Read MoreReal estate investments have long been considered a pivotal asset in portfolio diversification. Historically, investing in real estate has often meant purchasing physical properties, managing tenants, and dealing with maintenance issues.

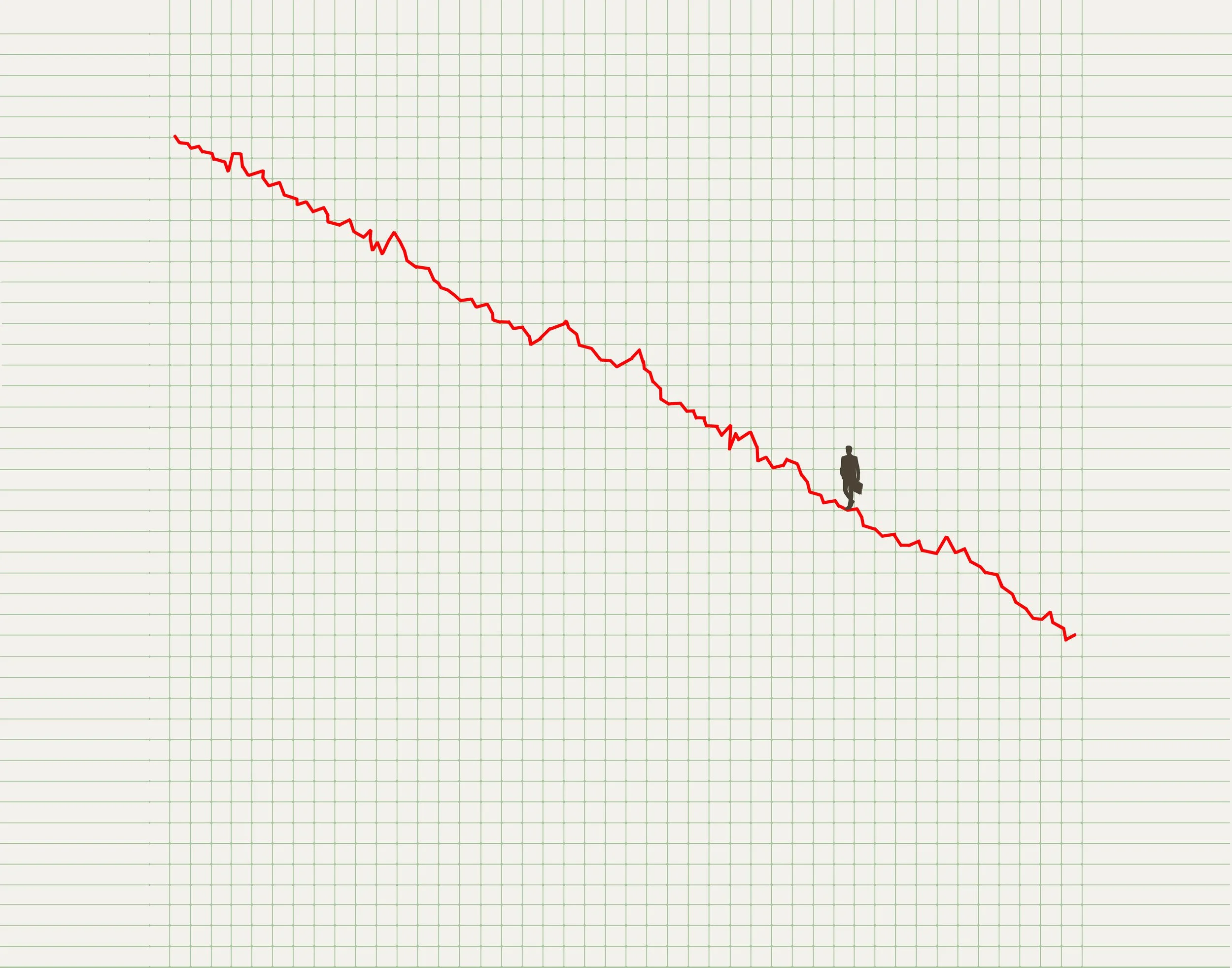

Read MoreCash has its place in any financial plan. However, holding too much cash or cash-like investments like a CD or a Money Market account can be one of the most overlooked risks when it comes to long-term planning.

Read More