Maximizing Returns with Short-Term Cash in Your Investment Portfolio

When managing an investment portfolio, cash is often seen as a low-return, almost idle asset. However, understanding the role of short-term cash in your investment strategy can be a game changer. By thoughtfully managing cash holdings, you can enhance your portfolio's flexibility, reduce risk, and seize timely opportunities. In this post, we'll explore why holding short-term cash can be a smart move and how to make the most of it.

The Role of Short-Term Cash in a Portfolio

Cash is the most liquid asset in any investment portfolio, offering greater flexibility and accessibility. While it may seem counterintuitive to keep a portion of your portfolio in cash when higher returns are available elsewhere, the purpose of short-term cash is not just about earning returns—it's about risk management and readiness.

Liquidity and Flexibility: Cash allows you to act quickly when market opportunities arise. Whether it's buying into a market dip or taking advantage of a promising investment, having cash on hand enables you to make moves without needing to sell other assets at potentially unfavorable times.

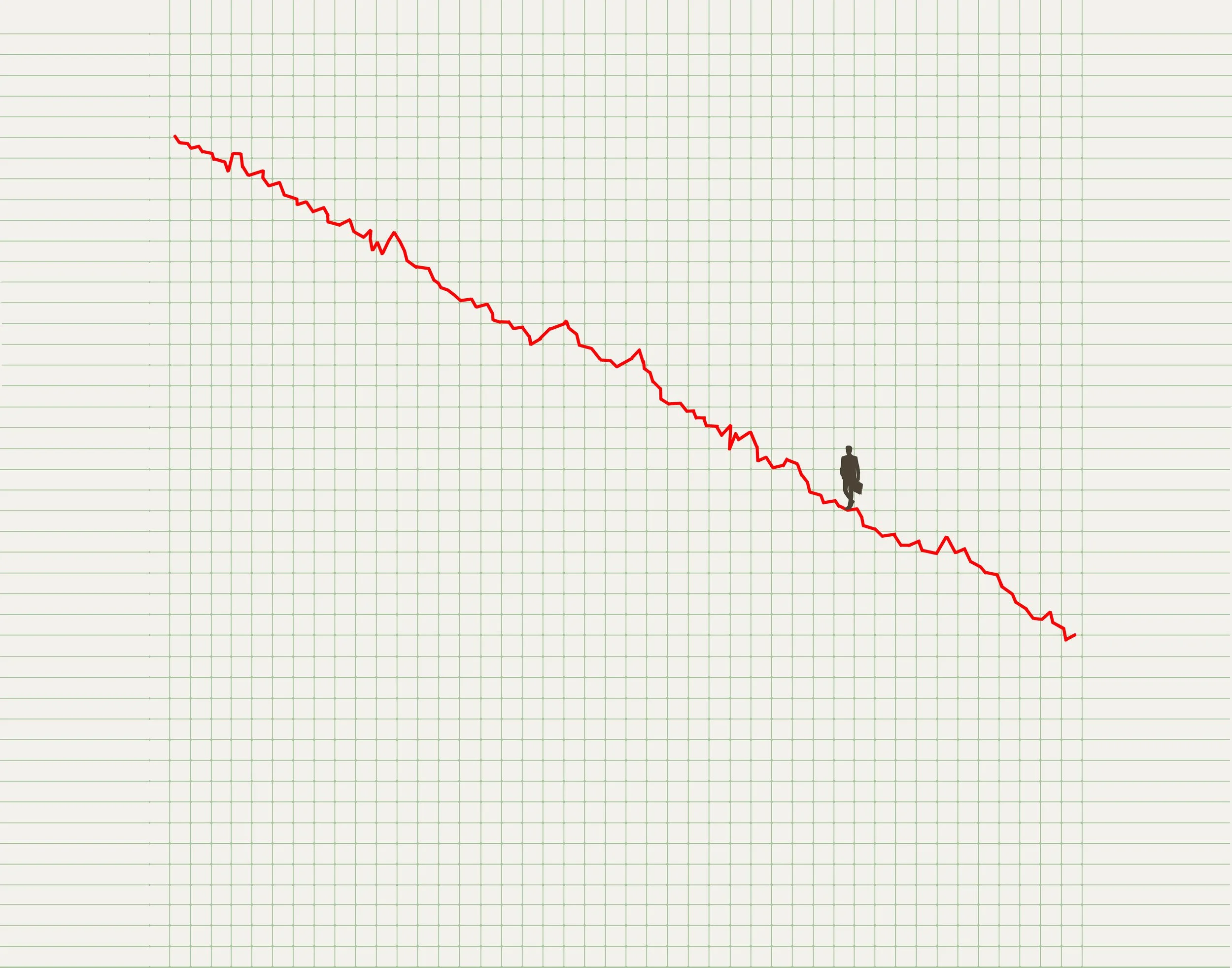

Risk Management: In volatile markets, cash serves as a buffer, reducing the overall risk of your portfolio. During market downturns, cash holdings can protect you from losses, offering a sense of security and stability.

Strategic Uses of Short-Term Cash

To maximize the benefits of holding cash, it’s essential to have a clear strategy for its use. Here are some key ways to leverage short-term cash in your portfolio:

Emergency Fund: One of the primary reasons for holding cash is to ensure that you have an emergency fund. This fund acts as a financial cushion, allowing you to cover unexpected expenses without liquidating other investments.

Opportunity Fund: Markets are cyclical, and opportunities often arise when others are unprepared. Having cash ready allows you to invest in undervalued assets, take advantage of new investment opportunities, or even capitalize on short-term market inefficiencies.

Where to Park Short-Term Cash

Not all cash equivalents are created equal. To maximize returns on your short-term cash, consider these options:

High-Yield Savings Accounts: These accounts offer higher interest rates than traditional savings accounts while still providing easy access to your funds. They are an excellent place to park cash that you may need within a short timeframe.

Money Market Funds: These funds invest in short-term, high-quality securities and typically offer better returns than savings accounts. They also provide liquidity, though they may have some risks and fees.

Treasury Bills (T-Bills): U.S. Treasury bills are a low-risk investment with maturities ranging from a few days to a year. They are backed by the full faith and credit of the U.S. government, making them a secure place to store short-term cash.

Certificates of Deposit (CDs): For cash that you won't need immediately, CDs offer higher interest rates in exchange for locking your money away for a set period. Check with your local credit union to learn current rates and terms and to understand potential penalties for early withdrawal.

Balancing Cash with Other Investments

While holding cash is important, it’s crucial to balance it with other investments to ensure your portfolio continues to grow. Over-allocating to cash can lead to missed opportunities for higher returns in equities, bonds, or other assets. The key is to determine the right amount of cash to hold based on your financial goals, risk tolerance, and market conditions.

Assess Your Financial Goals: If you have short-term goals, such as buying a home or funding education, a larger cash allocation may be necessary. For long-term goals like retirement, cash should be more of a strategic reserve than a primary holding.

Monitor Market Conditions: In times of high market volatility or uncertainty, increasing your cash allocation can be a wise defensive strategy. Conversely, in a bull market, it might make sense to reduce cash holdings and invest more in growth opportunities.

Short-term cash plays an important role in a well-rounded investment portfolio. It provides liquidity, flexibility, and a safeguard against market volatility. By strategically managing your cash holdings, you can ensure that your portfolio is prepared for both opportunities and challenges, helping you achieve your financial goals with greater confidence.

Investing is not just about chasing returns—it's about building a strategy that aligns with your risk tolerance and financial objectives. If you have questions about the amount of cash or short-term investments in your portfolio, connect with your advisor to learn more about your specific strategy and make sure it aligns with your needs.