What is the Secret to Successful Investing?

Through the end of 2019 and dating back 20 years, the S&P 500 returned 6.1%, as described in Table 1 below. During that same time period, a balanced account consisting of 60% stocks and 40% bonds returned 5.6%, while the “average investor” returned just 2.5%.

Table 1

The “average investor”, according to JP Morgan and Dallbar, is any investor investing in mutual funds. The report shows the flow of mutual fund buying and selling. The use of mutual funds is the best way to perform a field experiment and infer approximate returns for those buying and selling mutual funds.

It is implied that those buying mutual funds are more individuals, households, and smaller institutions. Larger institutional clients typically own the investments directly.

SO, WHAT’S THE DEAL WITH THE AVERAGE INVESTOR RETURNS?

Why don’t more people invest 100% of their money into the S&P 500 or something similar? The short answer is that while any investor can put their money into the S&P 500, few are able to hold through the ups and downs.

Table 2

Looking at Table 2 (using the same 20-year time period), the S&P 500 has seen intra-year drops, that were on average nearly 14%. Investors owning just the S&P 500 would have had to hold tight over those 20 years to achieve the 6.1% return, which is easier said than done. To be sure, there is so much that goes into selecting an allocation for a portfolio. But given the times we are in, I thought it would be useful to lay out a framework for successful investing.

Diversify — In my nearly 24 years of advising clients, I have seen just a few that have been 100% invested in equities. Since 1950, the average all-stock portfolio return was a little over 11%. Interestingly, a 50% stock and 50% bond portfolio for that same period yielded just under 9%. Although an investor may not have the temperament for an all-stock portfolio experience (because of the volatility described in Table 2), they can still save and invest. Through a balanced portfolio, investors can experience a fraction of the expected volatility while still achieving solid returns.

Plan — It baffles me that so many investors focus on the return of the stock market. From my point of view, the only number that should matter is the return an investor needs to achieve their stated goals. Recently, we ran planning calculations for a client that needed 5.5% returns to make all of her financial goals come to fruition. Since working with Human Investing, she has achieved a 6% net return, allowing her to achieve all of her goals. Investors are best off spending time developing a plan and then building a diversified portfolio to achieve those plans.

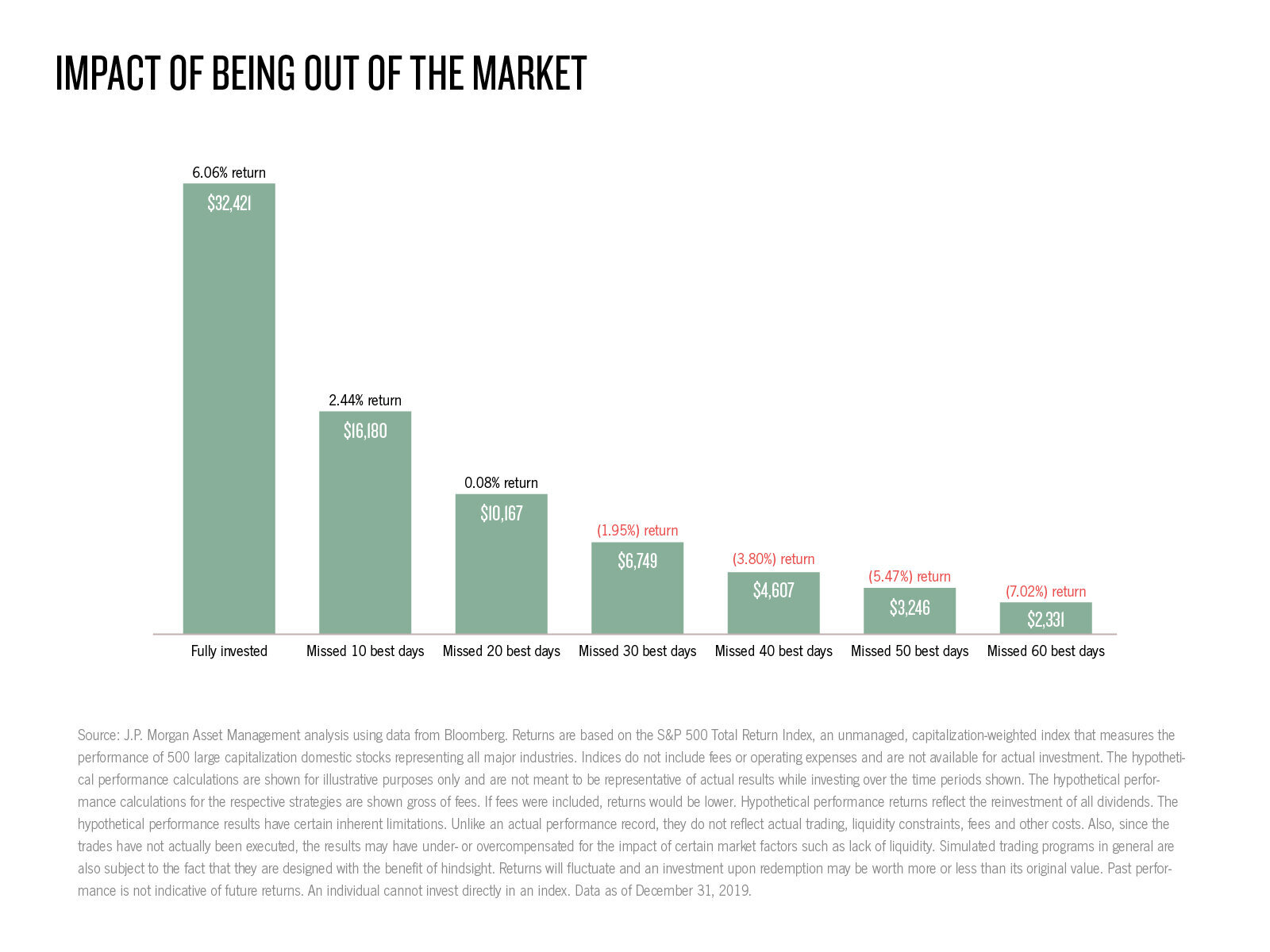

Stay in the market — Since your financial plan serves as your road map to achieve your financial goals, it is imperative to stick to the plan. Following the plan means staying invested even when the world appears to be falling apart. But, what if you decide not to follow the plan and get out of the market? It may not be so much about the getting out of the market but about getting back in. Table three describes the negative impact of market timing. Although market timing can be costly, the greater challenge may be the decision on when to get back into the market.

Investing is forever — Successful investors have a forever time frame they measure in a lifetime, not a day. The accelerating adoption of day trading, market timing, and other gambling-like tendencies go against everything I have ever read and learned about successful investing. Take, for example, Warren Buffett, whom many consider the greatest investor of our generation. He has amassed 95% of his wealth after the age of 65. Although I would place Buffett near the top of the list as the greatest investor of our generation, a key contributor to his wealth accumulation has been the length of time he has spent investing. This is a crucial lesson for those who look to get rich quickly and bypass the hard work of saving and investing over a lifetime.

Table 3